Fraud Protection and Compliance: Safeguarding Transactions with Credit Card Payment Processors

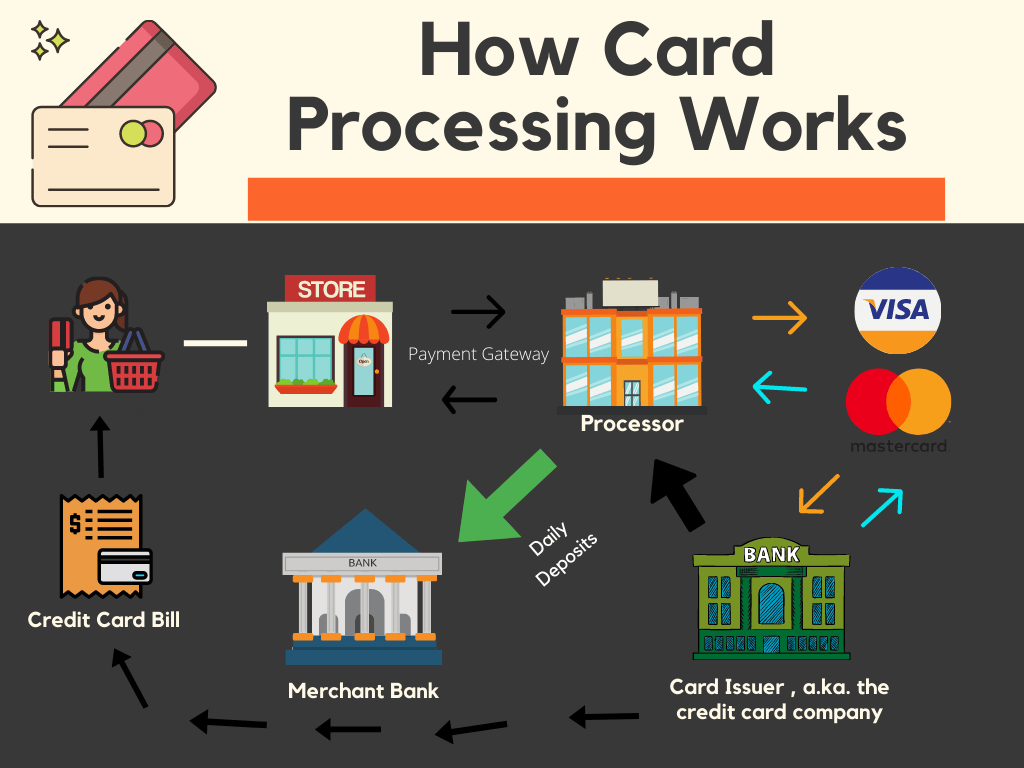

A charge card payment processor represents a critical position in the current financial landscape, providing because the linchpin that facilitates electronic transactions between suppliers and customers. These processors become intermediaries, linking organizations with the banking process and permitting the smooth move of funds. The fact of their function lies in translating the info from a bank card exchange right into a language clear by economic institutions, ensuring that payments are licensed, prepared, and settled efficiently.

One of many primary operates of a bank card payment model is to enhance the performance of transactions. When a customer swipes, inserts, or taps their bank card, the payment processor swiftly assesses the deal details, communicates with the applicable financial institutions, and validates whether the purchase can proceed. This process does occur in a subject of moments, emphasizing the pace and real-time character of charge card cost processing.

Security is really a paramount issue in the region of economic transactions, and credit card payment processors are in the forefront of utilizing actions to safeguard sensitive information. Sophisticated encryption systems and compliance with industry requirements make sure that customer information stays protected throughout the cost process. These security steps not just safeguard consumers but additionally impress rely upon corporations adopting electronic cost methods.

The charge card payment processing environment is frequently developing, with processors establishing to scientific improvements and adjusting consumer preferences. Portable obligations, contactless transactions, and the integration of electronic wallets represent the lead of innovation in that domain. Credit card payment processors play a crucial position in allowing organizations to remain forward of these traits, giving the infrastructure required to aid varied cost methods.

Beyond the standard brick-and-mortar retail place, bank card cost processors are instrumental in powering the substantial landscape of e-commerce. With the increase of on line buying, processors help transactions in a digital setting, managing the complexities of card-not-present scenarios. The ability to seamlessly navigate the difficulties of electronic commerce underscores the adaptability and usefulness of charge card cost processors.

Global commerce depends heavily on credit card cost processors to help transactions across borders. These processors control currency conversions, address global conformity demands, and ensure that organizations can operate on a global scale. The interconnectedness of financial programs, reinforced by credit card cost processors, has developed commerce right into a really borderless endeavor.

Credit card payment processors contribute considerably to the development and sustainability of small businesses. By providing electronic cost possibilities, these processors enable smaller enterprises to expand their client bottom and contend on a level playing area with greater counterparts. The accessibility and affordability of charge card payment running solutions have grown to be crucial enablers for entrepreneurial ventures.

The landscape of credit card cost handling also requires considerations of fraud prevention and regulatory compliance. Payment processors implement strong measures to identify and prevent fraudulent actions, defending both organizations and consumers. Furthermore, staying abreast of ever-evolving regulatory demands ensures that transactions stick to how to become a payment processor requirements, reinforcing the reliability and strength of the cost handling industry.

In summary, credit card cost processors type the backbone of contemporary financial transactions, facilitating the clean movement of resources between firms and consumers. Their multifaceted position encompasses pace, security, adaptability to technical adjustments, and support for worldwide commerce. As engineering continues to improve and consumer tastes evolve, credit card payment processors may remain main to the powerful landscape of electric transactions, surrounding the continuing future of commerce worldwide.